Co-ownership: Nature, Risks, Termination, Instructive Examples

Co-ownership: nature, risks, termination, instructive examples

Co-ownership, which as is well known has caused considerable headaches for many people, is being broken down piece by piece by Siim Kabel, head of the residential properties department at Kaanon Real Estate, and broker Annemai Tuvike.

What is co-ownership?

Co-ownership is ownership that belongs simultaneously to two or more persons as ideational shares in a joint thing. When one thing has multiple owners, co-ownership arises. Such ownership is created through inheritance, the return of property to multiple persons, or the purchase of a single property by multiple persons. The return of property to multiple persons is the main reason why many properties are still in co-ownership today.

Modern co-ownerships have generally arisen through inheritance. For example, a family has two children and when both parents have passed away, the children inherit the parents' property in equal shares. This is of course the case if the will does not provide otherwise.

The shares of co-owners in a joint thing are equal. If they are not, this must be determined either by contract or by law. In co-ownership, there are also jointly used spaces in apartment buildings: roof, external walls, foundation, plot, etc.

Co-ownership is not an eternal form of ownership. According to the Law of Property Rights, a co-owner always has the right to demand the termination of co-ownership without providing grounds for it, unless this is excluded by an agreement between co-owners. Co-owners must treat each other in accordance with the principle of good faith and co-ownership must be terminated in a manner that burdens the co-owners the least.

What risks are associated with buying property when it is co-ownership?

Buying or selling co-owned property is more complicated than buying or selling an apartment. When buying such property, one must take into account that the bank may not provide a loan if there is no deed of use, as a result of which it may happen that the potential buyer must have full self-financing. If the use of co-ownership is agreed upon by a notarial deed of use, then the bank is also more willing to provide a loan.

A notarial deed of use shows which part of the real property is exclusively used by one or another co-owner and which parts of the property remain in common use. This agreement is formalized with a notary and entered in the land register. When buying property in co-ownership, it is always advisable to check whether there is an appropriate entry in the land register, because only this confirms the existence of a notarial deed of use. The corresponding agreement is transferred to each subsequent owner upon change of ownership. Without a notarial deed of use, neighbors have the right to use any part of the property. A common example is buildings that are divided so that one family lives on the first floor and another family lives on the second floor.

When selling, one must take into account that a co-owner generally has a right of first refusal for the other person's share being sold. According to the provision of the Law of Property Rights that was in effect until 2005, a co-owner had a right of first refusal to purchase the real property upon alienation of the real property even in case of forced sale. According to the currently applicable Enforcement Procedure Act, the right of first refusal cannot be used in a forced sale.

However, the other co-owner does not have unlimited time to exercise their right of first refusal. After the purchase and sale transaction, the co-owner with the right of first refusal must exercise their right within two months (unless the law or contract provides otherwise).

According to the Law of Obligations, the person with the right of first refusal must be notified without delay of the purchase and sale agreement concluded with the buyer, its contents and all the terms of the contract that may affect their decision to exercise their right of first refusal. Therefore, the seller must, at the request of the person with the right of first refusal, present the contract to them.

This (two months) does not apply if the co-owner alienates the ideational share in the joint thing to a lineal relative (child) or parent of the co-owner. A co-owner has the right to alienate, bequeath, pledge or otherwise dispose of the ideational share in the joint thing that belongs to them.

Co-ownership involves the division of a thing among multiple owners who may have very different interests and objectives regarding the thing, which is why co-ownership often gives rise to disputes.

The most common problem that causes disputes between owners of co-owned property is when they want to terminate the co-ownership and the co-owners cannot reach an agreement among themselves, as a result of which the court decides on the termination of co-ownership. Most often this occurs in cases where the property owners are people from several different households, but there have also been situations where the property owners are from one household and cannot reach an agreement.

Likewise, common dispute cases are those where co-owners cannot reach an agreement on bearing the costs of the property. Questions related to co-ownership can be resolved solely and only by an agreement according to which all co-owners have unanimity on the matter.

Additionally, one problematic aspect is that one co-owner has the right to incur expenses without asking the other co-owner in order to maintain and preserve the property, if this is necessary (e.g., the roof is leaking). Afterwards, they can ask the other co-owner to reimburse the expenses proportionately according to their share.

Are there any advantages to co-ownership?

Rather, there are no advantages, because disputes between co-owners are very easy to arise. Co-ownership is a relatively complicated form of ownership and if one does not know the laws and dangers, it is very easy to end up in complicated situations.

How to terminate co-ownership?

-

Division of the thing into real shares

Any property in co-ownership can be divided into apartment ownerships if the building contains separately identifiable apartments as real shares. Each apartment ownership in this case consists of an apartment and its corresponding ideational share in the property and the building's supporting structures. Each such apartment ownership is an independent real property.

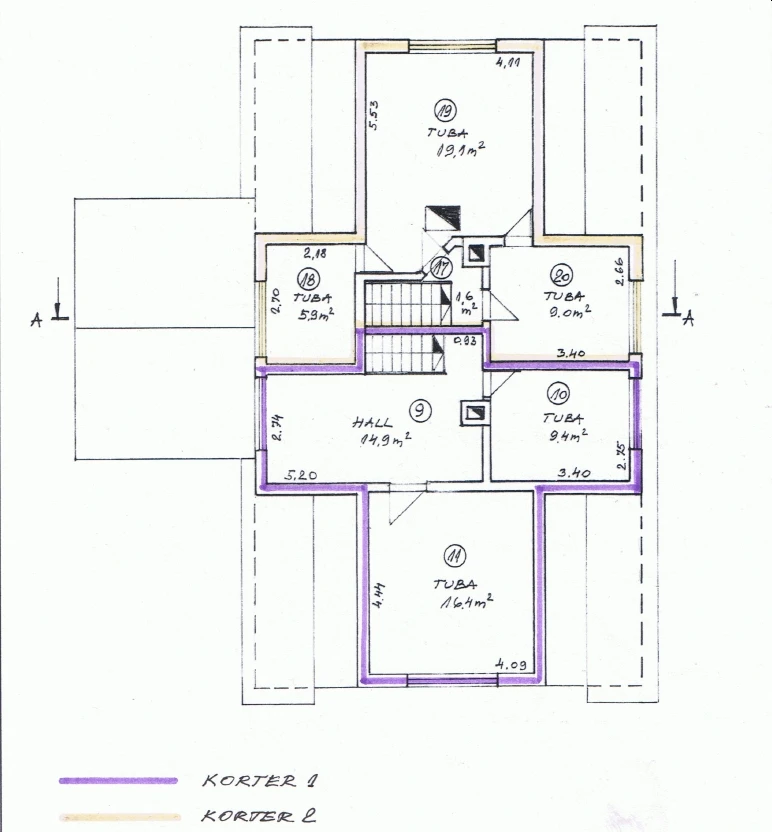

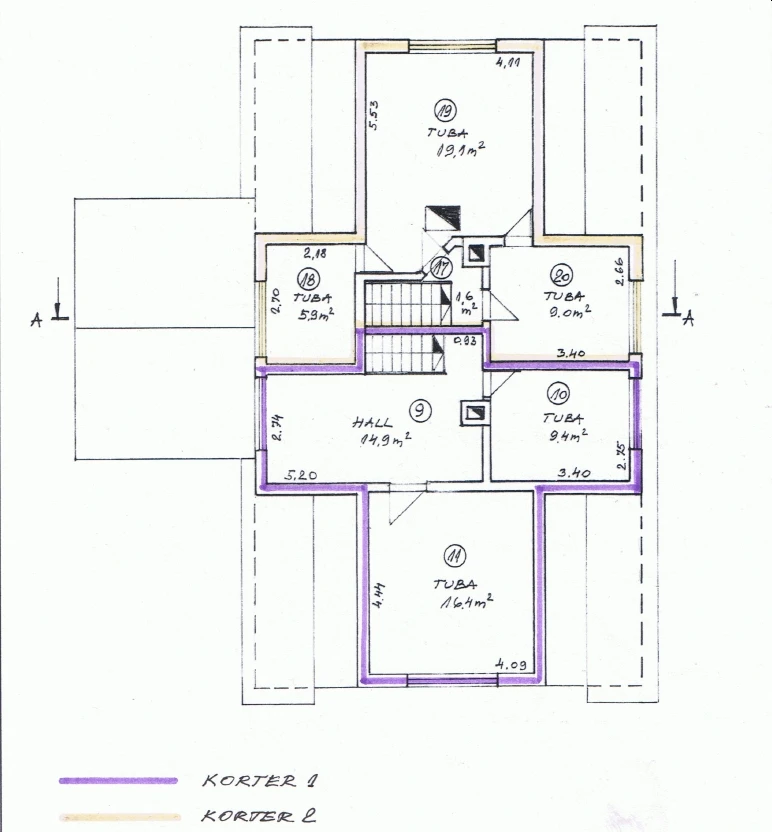

Terminating co-ownership by dividing the thing into real shares means that a certain part of the real property remains in the sole ownership of the co-owner. In this case, it is quite normal for some spaces to remain in common use (e.g., stairwell, attic, basement, courtyard, sheds, sauna, etc.). It is advisable to make a notarial deed of use together with the apartment ownership division agreement to avoid future disputes. Thus, the owners can decide themselves what will become part of the residents' sole ownership and what will remain in common use.

In order for it to be possible to terminate co-ownership at a notary by dividing the thing into real shares, prior consent of the local government (LG) construction specialist and confirmation by an architect that it is possible to create apartment ownerships on this property is required. Additionally, correct data in the building register and floor plans corresponding to reality are necessary. If no alterations have been made to the property, then it is often possible to use old inventory drawings as well.

Using these plans, it is possible to draw the boundaries of real shares (read: apartments). If plans corresponding to reality do not exist, the owner can be helped by an architect or construction engineer who will calculate the sizes of the ideational shares belonging to the apartments. Once the boundaries are set by the co-owners, confirmed by the LG and architect, it is possible for all co-owners to go to the notary and formalize the corresponding agreement. Floor plan and property plans are attached to the apartment ownership establishment agreement, showing the boundaries of each apartment, the spaces remaining in common use and the ideational shares of the property. Based on this agreement, the corresponding entry is also made in the land register.

When establishing apartment ownerships or agreeing on a notarial deed of use, notary fees and state duty must be paid in both cases, which depend on the value of the property. The co-owners agree among themselves on the division of costs. Often these are divided into equal parts or divided according to the sizes of the co-ownership shares.

The size of the co-ownership ideational share typically represents the ratio of a specific apartment and the sum of all apartments' enclosed net floor area. The establishment of apartment ownerships takes time and is expensive, which is why it is faster and more cost-effective for the owners to agree on a notarial deed of use for the property remaining in co-ownership (the building and courtyard) and outbuildings.

A plan attached to the deed of use generally does not require separate confirmation from the local government. The co-ownership share thus determined is equally alienable and pledgeable as an apartment ownership. Therefore, it is often an emotional question, since some owners want to have their apartment as a real share in sole ownership, rather than just an exclusive use right associated with an ideational share.

If the value of real shares does not correspond to the value of the ideational shares belonging to the co-owners, it is possible to agree or the court may determine financial compensation upon division of co-ownership into real shares to balance the shares, and also burden individual shares with an easement for the benefit of other shares.

If it is at all possible to terminate co-ownership by establishing apartment ownerships, it is worth doing so to avoid future disputes and conflicts between co-owners.

-

Purchase of one or more co-owners' shares

A common and one simpler way to terminate co-ownership is a situation where one co-owner buys out another co-owner's share and thereby becomes the sole owner of the thing. In this case, they are obligated to pay the co-owners their share in cash. Typically, this method is used to terminate co-ownership when the real property cannot be divided due to its nature or when division is not reasonable taking into account the relationship between co-owners. This requires that the other co-owners consent to the conclusion of the corresponding agreement. Also, for the corresponding entry to be made in the land register, upon which the entire property belongs to one owner and with the corresponding entry the co-ownership is terminated.

Making entries in the land register requires a will declaration. Those co-owners who lose their share must be provided compensation. To do this, it is generally necessary to assess the value of the thing in co-ownership as a whole at a specific moment in time and based on this, calculate the share of the co-owner in cash based on the size of their ideational share. In this case, the co-owners must reach a joint agreement on the final price. If no agreement is reached, an expert appraisal of the property must be obtained to clarify the value.

-

Sale of the thing at an auction between co-owners or a public auction

This option is justified primarily if all co-owners wish to terminate the co-ownership, but none of them is interested in becoming the sole owner and division of the thing into real shares is not possible. This option is also justified in terminating co-ownership in a situation where multiple co-owners wish to acquire the thing at the same time. The co-owner who pays more gets the real property or it is sold at a public auction to a third party. At a public auction, the parties can decide at what initial price they will start the sale. Co-ownership ends when the real property is sold.

Without an agreement between all parties or even by majority decision, co-ownership cannot be terminated. Such a request must first be presented to the other co-owners and if they cannot reach an agreement on the termination of co-ownership, they must turn to court. The law provides for the possibility that in difficult cases, a lottery can also be used to determine which part of the property goes to whom.

Real-life examples of situations where co-ownership caused considerable headaches

- Example: I had to sell a one-room apartment in a Tallinn housing estate that had been left to the owner's heirs after their death. Specifically, the widowed owner had three children who should have each received 1/3 of the apartment ownership, but unfortunately one of the children had also passed away and they in turn had three children. Therefore, the apartment ownership was divided as follows:

~33.3% of the apartment ownership to the first child

~33.3% of the apartment ownership to the second child

~11.1% of the apartment ownership to one grandchild

~11.1% of the apartment ownership to the second grandchild

~11.1% of the apartment ownership to the third grandchild

To make matters even more complicated, two grandchildren were minors, so a court decision was needed to sell their share.

Finally, after a lot of hard work, we received a court decision and also found a way for all owners and the potential buyer to go to the notary at the same time – of course, not all heirs were from Tallinn.

Fortunately, there was no dispute over the property shares in this family. The entire process from initial sales consideration to the transaction lasted approximately three years.

If parents have multiple children, it is worth saving them by either gifting the property to one child or selling the property and dividing the money among them. Subsequent division of assets by heirs is not good fortune, but a great misfortune, and there have been cases where brothers and sisters quarrel after receiving an inheritance in such a way that they do not speak to each other for the rest of their lives.

- Example: I had to sell a part of a house; the property was in co-ownership (the property had two owners from different households). A notarial deed of use had not been established, but the neighbors had quarreled with each other, so the boundaries had been set by a court order (a court order may also replace a notarial deed of use).

I found a buyer for the house part who was willing to wait, but his requirement was that the apartment ownerships be established before the purchase and sale transaction. Since the neighbors were in continued conflict with each other, all communication went through me. The situation had to be clarified for both parties, as the neighbors did not wish to interact much with each other and one co-owner was an elderly couple for whom the entire process was very complicated.

Fortunately, I was able to get both parties to agree on the establishment of apartment ownerships. The situation was simplified by the fact that the property had previously been surveyed and correct plans were already in existence. A few things needed to be sorted out in the building register (for example, one outbuilding and a few other things had not been entered in the register), but generally the data was in order. The plans needed to be approved by the city government and an architect, and an agreement also needed to be reached on where the boundaries between the owners' properties would be on the property.

I found a buyer in November, and I reached the purchase and sale transaction the following spring, so the entire process lasted approximately six months.

Source: Kaanon Real Estate