How Much Does Condition Affect Insurance Options for a House or Apartment?

Although new developments are gaining popularity, 90% of Estonian residential properties were built in the previous century. The older a house or apartment is, the more complicated it is to insure, and owners often complain about this in various social media groups. How to insure an older residential building was explained by Raivo Piibor, the head of Coop Bank's Insurance Brokerage.

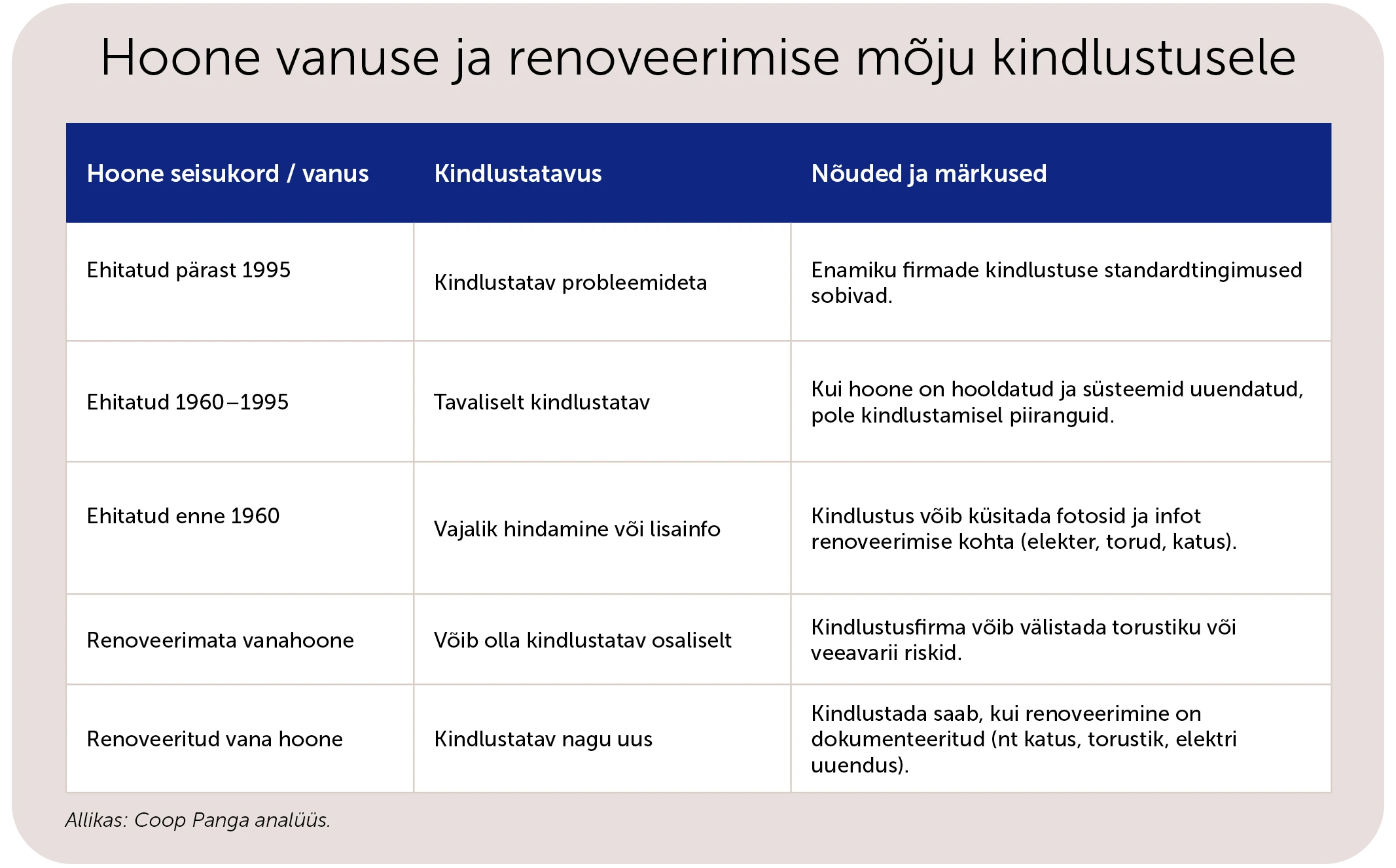

Piibor confirmed that in Estonia, it is possible to insure older residential buildings, including those built before 1960, but their insurance solutions depend on the specific condition of the building and the conditions of the insurance company.

He said that every building where people live is someone's home and deserves protection against unexpected events. "A home – regardless of whether it is new or old, in very good condition or somewhat worse – is a place where every person feels the safest. If someone's home were to experience an accident, such as a fire, water damage, or storm, the sense of security and stability of the people living in that home would be lost in an instant. Home insurance helps restore not only the building but also emotional and practical peace of mind," said Piibor.

For this reason, he encourages people to insure older residential buildings as well and highlighted the conditions under which this can be done. "An insurance company only insures buildings that are fit for use and well-maintained. This means the roof must be waterproof and intact. The walls and foundation must be stable. Electrical and heating systems must be safe. The building must not have mold, rot, or structural damage," listed Piibor.

Among other things, the existence of insurance is important when you want to buy an older building with a home loan or when you want to use it as additional collateral for a bank loan when buying a new home – in both cases, the existence of insurance is an important prerequisite of the loan agreement, as it protects both the borrower and the bank in case of an accident. In some cases, banks may finance building renovation plans without insurance, but in such cases, it is agreed in detail what timeframe the building will reach the condition necessary for insurance.

Insurance Peculiarities

Piibor added that if a building is in a state of decay or uninhabitable, insurance may not take it under insurance coverage or may only offer partial coverage.

For example, IF Insurance insures buildings built before 1950 if they are in good condition. If necessary, photos are requested or an assessment is conducted. ERGO only insures habitable buildings and excludes certain risks in case of defects, PZU also insures old buildings, but the age of plumbing and electrical systems affects the risk, and with BTA, insurance of old buildings often has a higher deductible.

Piibor explained that in general, an insurance company may refuse to offer insurance or limit coverage if the building has been standing empty for more than six months, its structures are damaged – for example, the roof has collapsed and walls have cracked –, electrical or heating systems are dangerous or old, the building has no insurance value, meaning it is not economically recoverable. The latter means that the building is in such poor condition that its repair or reconstruction is not financially sensible or worthwhile.

Piibor also highlights four main steps to start insuring an older residential building:

1. Take photos of the building for insurance: roof, plumbing, electrical system, heating elements.

2. Write down the dates of recent repairs performed (e.g., pipes 2010, roof 2015).

3. If something has deteriorated, plan repairs – completed repairs can also help reduce the insurance premium.

4. Request insurance quotes from multiple companies based on the same information and keep in mind that assessment criteria may differ, or contact an insurance broker to save time, who will request quotes themselves and prepare the comparison.